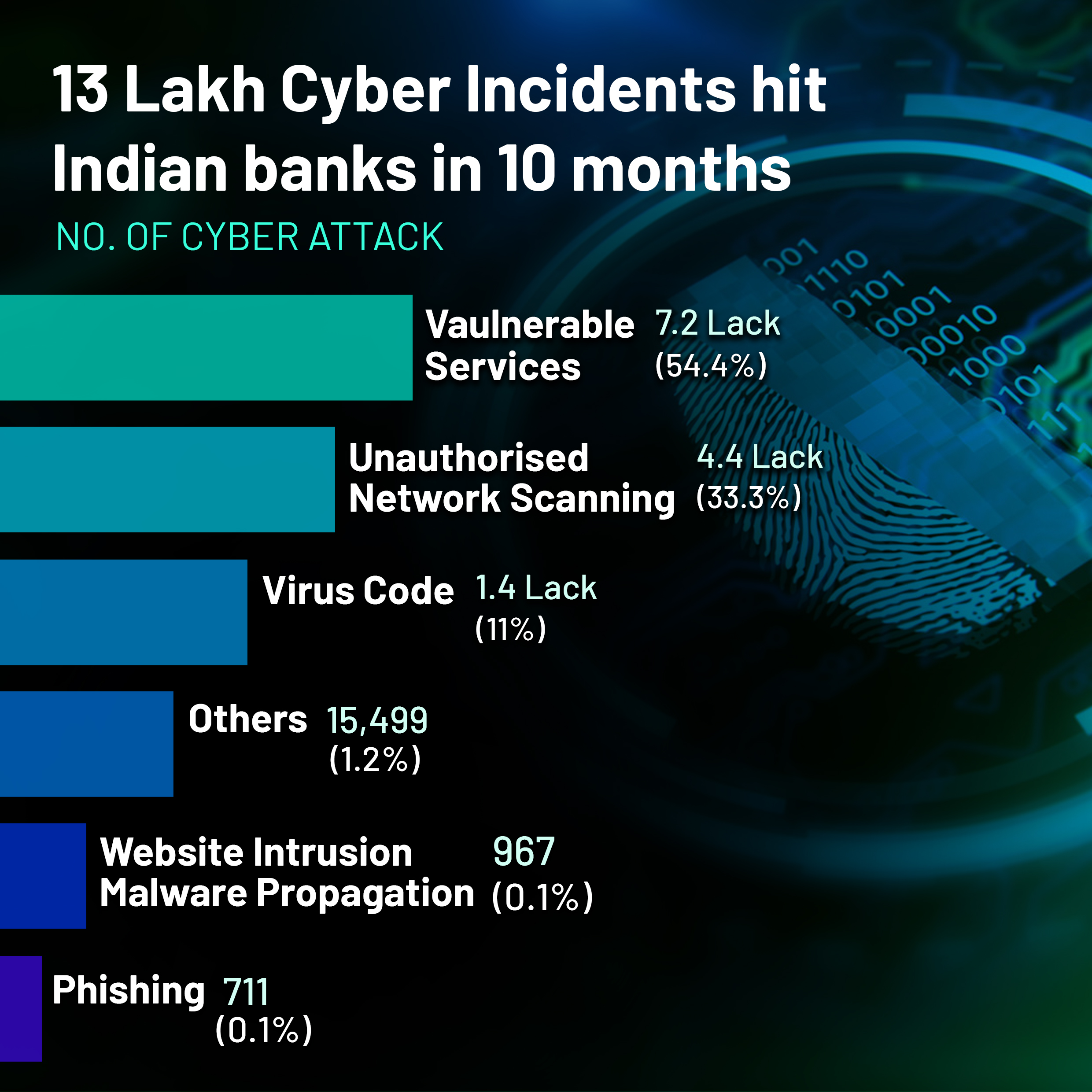

The financial industry is undergoing a significant transformation, driven by rapidly evolving regulations, increasing customer expectations, and the relentless pace of technological advancements. With cyberattacks on financial institutions in India increasing by 29% in the last year alone and nearly 25% of all global cyberattacks targeting the financial sector, banks are at constant risk of data breaches and financial losses. In this high-stakes environment, the ability of your staff to quickly adapt and respond to new challenges isn’t just a nice-to-have—it’s a necessity.

But here’s the problem: Traditional training methods often fall short of preparing employees for the real-world pressures they face every day. The consequences of inadequate training can be severe, leading to compliance failures, security breaches, and ultimately, a loss of customer trust.

This blog delves into the specific issues that banks face in their training programs and offers solutions that can help your financial institution not just keep up, but stay ahead in this demanding landscape.

The Challenges of Employee Training in Banks

Bank training programs face several persistent obstacles that limit their effectiveness:

1. Information Overload

Employees are inundated with new policies, regulatory changes, and procedural updates, making it difficult for them to absorb and retain essential information. This can lead to confusion, mistakes, and inefficiencies in daily operations.

2. Low Engagement Levels

Traditional training formats—such as lengthy manuals and outdated e-learning modules—fail to capture employees’ interest, resulting in disengagement and poor retention of knowledge.

3. Rapid Industry Changes

The financial sector experiences constant shifts in regulatory frameworks, new product introductions, and evolving cybersecurity threats. Keeping training programs updated in real-time is a challenge for many banks.

4. The Need for Continuous Cybersecurity Training

Cybersecurity isn’t a one-time lesson—it requires ongoing reinforcement to ensure employees remain vigilant against evolving cyber threats. However, many training programs lack the necessary structure for continuous learning.

5. Measuring Training Effectiveness

How do banks gauge whether their employees have successfully absorbed and applied their training? Without proper tracking mechanisms, it becomes difficult to measure progress and identify gaps in knowledge.

A Strategic Approach to Overcoming Training Challenges

To address these challenges, banks must embrace modern, technology-driven approaches to training. A multi-faceted strategy should include:

- Implementing a centralized platform for training content and real-time updates.

- Leveraging engaging, non-intrusive formats such as screensavers, digital signage, and interactive modules.

- Personalizing training content based on employees’ roles, departments, and expertise levels.

- Establishing real-time feedback loops to track engagement and measure knowledge retention.

Is your bank’s training program equipped to handle today’s industry challenges?

This is where QComm provides a game-changing solution.

The Role of QComm in Transforming Training Programs

QComm is designed to streamline and enhance bank training programs, making learning more engaging, accessible, and effective.

Here’s how QComm revolutionizes employee training:

1. Centralized Communication

QComm enables banks to seamlessly deliver training updates, policy changes, and reminders through a unified platform. With real-time message receipts, banks can ensure that over 95% of crucial updates are acknowledged the same day, reducing miscommunication and training lapses.

2. Engaging Screensavers for Continuous Learning

QComm transforms screensavers into interactive learning tools. Important training messages, security reminders, and compliance updates appear directly on employees’ screens, reinforcing key information throughout the workday without interrupting workflow.

3. Dynamic Digital Signage

By displaying training materials on digital screens across bank branches and corporate offices, QComm ensures continuous exposure to vital knowledge. Whether highlighting new security protocols or promoting financial compliance best practices, digital signage reinforces learning in a visually engaging format.

4. Customizable Alerts for Targeted Training

QComm’s customizable alert system ensures that the right training notifications reach the right employees at the right time. With alerts tailored to specific roles, departments, or locations, banks can optimize learning efficiency and ensure compliance with industry regulations.

5. Real-Time Monitoring and Feedback Mechanisms

QComm enables banks to track employee engagement and learning progress in real-time. Advanced analytics provide insights into training effectiveness, identifying areas that require additional focus to strengthen cybersecurity awareness and compliance measures

Conclusion: Empowering Employees Through Innovative Training

In today’s rapidly evolving financial sector, effective employee training isn’t optional—it’s essential. Banks that prioritize continuous learning and innovative communication strategies gain a competitive advantage, ensuring their workforce remains well-equipped to handle compliance requirements, cybersecurity threats, and industry changes.

How are you preparing your employees for the challenges of tomorrow?

Don’t let outdated training methods hinder your bank’s success. With QComm, your training initiatives become more efficient, engaging, and impactful, ensuring compliance while fostering a culture of continuous learning.