In the banking industry, where trust, efficiency, and compliance are paramount, seamless internal communication is not a luxury—it’s a necessity. Yet, many banks continue to struggle with outdated communication channels that hinder productivity, create information silos, and ultimately affect customer service. Overloaded email inboxes, missed critical updates, and inconsistent messaging across branches are just some of the challenges banks face daily.

As the financial sector undergoes rapid digital transformation, banks must rethink their internal communication strategies. Effective communication is no longer just about relaying information—it’s about ensuring clarity, engagement, and real-time responsiveness.

In this blog, we explore why modernizing internal communication is crucial for banking institutions and how digital solutions like QComm can drive efficiency, compliance, and employee engagement.

Table of Contents

- The Pitfalls of Outdated Communication Methods

- The Role of Modern Internal Communication Tools

- The Impact of Effective Internal Communication on Banking Operations

- Case Study: How QComm Transformed Communication for a Leading Bank

- The Future of Internal Communication in Banking

- Conclusion: The Time to Act is Now

The Pitfalls of Outdated Communication Methods

For years, banks have relied on traditional communication methods such as emails, memos, and in-person meetings. While these methods have served their purpose, they no longer align with the fast-paced and digital-first environment of modern banking.

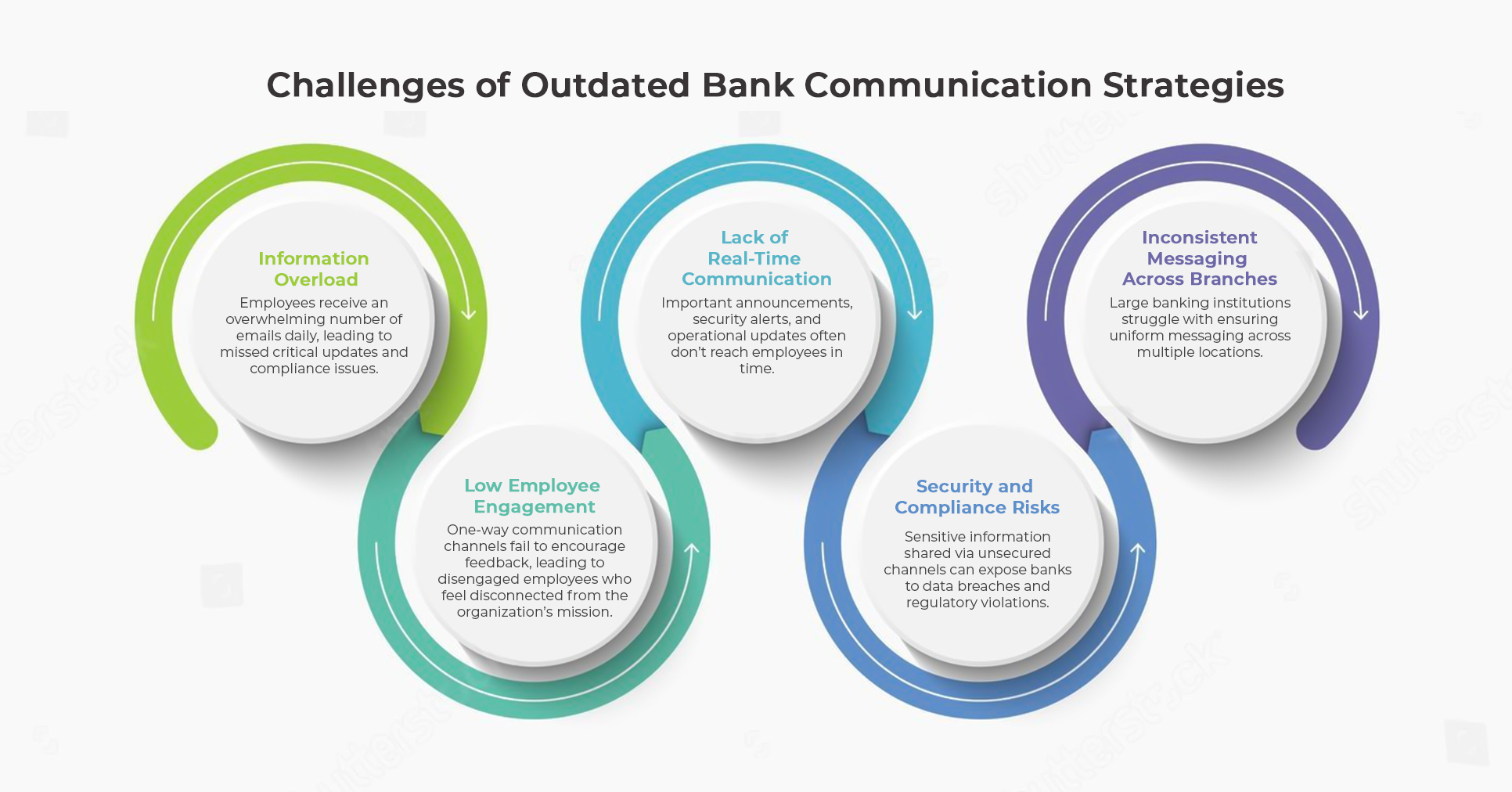

Here are some key challenges banks face with outdated communication strategies:

- Information Overload: Employees receive an overwhelming number of emails daily, leading to missed critical updates and compliance issues.

- Lack of Real-Time Communication: Important announcements, security alerts, and operational updates often don’t reach employees in time.

- Inconsistent Messaging Across Branches: Large banking institutions struggle with ensuring uniform messaging across multiple locations.

- Low Employee Engagement: One-way communication channels fail to encourage feedback, leading to disengaged employees who feel disconnected from the organization’s mission.

- Security and Compliance Risks: Sensitive information shared via unsecured channels can expose banks to data breaches and regulatory violations.

A communication breakdown within a bank does not just affect employees—it trickles down to customers, impacting their banking experience and overall satisfaction.

The Role of Modern Internal Communication Tools

To address these challenges, banks need to adopt a more dynamic and integrated approach to internal communication. This is where digital communication tools like QComm come into play, offering banks a seamless, real-time, and secure way to connect with employees at all levels.

Key Benefits of Digital Communication Solutions in Banking:

- Centralized Communication Hub: A single platform that integrates messaging, alerts, and company-wide updates ensures that employees receive the right information at the right time.

- Real-Time Notifications & Alerts: Urgent security updates, policy changes, or compliance reminders can be instantly shared across all branches.

- Customizable Employee Engagement Tools: Interactive dashboards, surveys, and feedback mechanisms keep employees informed and engaged.

- Data-Driven Insights: Advanced analytics help banks track communication effectiveness and optimize strategies accordingly.

- Enhanced Security & Compliance: End-to-end encryption ensures that sensitive banking information remains protected against cyber threats.

By leveraging these capabilities, banks can transform internal communication from a fragmented system into a streamlined, intelligent, and proactive network.

The Impact of Effective Internal Communication on Banking Operations

When a bank’s internal communication system is optimized, it leads to significant improvements in operations, employee satisfaction, and customer experience.

Let’s take a closer look at how a well-structured communication strategy benefits different areas of banking:

1. Boosting Employee Productivity and Morale

Banks operate in a high-pressure environment where employees handle complex financial transactions, regulatory requirements, and customer interactions daily. Effective communication ensures that employees stay informed, reducing confusion and enhancing productivity. Features like digital bulletin boards, automated reminders, and instant alerts eliminate unnecessary back-and-forth emails and keep teams aligned.

2. Strengthening Compliance and Security Awareness

With ever-evolving financial regulations, ensuring compliance is a top priority for banks. Traditional compliance training often fails to keep employees consistently updated on the latest policies. A digital communication platform enables banks to send real-time compliance alerts, conduct interactive training sessions, and track acknowledgment from employees to ensure adherence.

3. Enhancing Customer Experience and Satisfaction

Internal communication directly influences customer interactions. When frontline employees receive clear and consistent messaging about new products, promotions, or policy updates, they can relay accurate information to customers. This results in better service delivery, improved customer trust, and increased retention rates.

4. Crisis Management and Incident Response

Whether it’s a cybersecurity breach, a service outage, or an operational emergency, banks need a robust crisis communication plan. A centralized platform allows decision-makers to swiftly communicate critical information to employees, ensuring a coordinated response to mitigate risks and maintain business continuity.

Case Study: How QComm Transformed Communication for a Leading Bank

To illustrate the real-world impact of modern communication solutions, let’s examine how a major UAE-based bank overhauled its internal communication strategy with QComm’s innovative platform.

The Challenge:

With over 150 branches, the bank faced significant hurdles in maintaining consistent and effective communication. Policy updates were often delayed, employee engagement suffered, and compliance gaps posed serious risks. Critical security alerts were frequently missed, exposing the organization to operational vulnerabilities.

The Solution:

By integrating QComm’s cutting-edge internal communication system, the bank achieved:

- An 80% reduction in missed critical updates, ensuring timely dissemination of vital information.

- Enhanced regulatory compliance, facilitated by real-time alerts and acknowledgment tracking.

- A 12% increase in customer satisfaction scores, driven by improved employee engagement and streamlined internal processes.

- A unified communication strategy, ensuring that employees across all branches received consistent and accurate messaging.

This transformation not only optimized operational workflows but also reinforced the bank’s standing as a leader in innovation and customer service within the financial sector.

The Future of Internal Communication in Banking

As banks continue to embrace digital transformation, internal communication strategies must evolve accordingly. The future lies in real-time communication tools, real-time data insights, and omnichannel messaging platforms that bridge the gap between employees and decision-makers.

Banks that invest in modern internal communication solutions today will be better positioned to navigate future challenges, drive operational efficiency, and maintain a competitive edge in an increasingly digital financial landscape.

Conclusion: The Time to Act is Now

An effective internal communication strategy is no longer optional for banks—it’s a necessity. In a world where seamless connectivity is the foundation of success, relying on outdated methods is a risk that financial institutions cannot afford.

QComm provides a secure, intelligent, and scalable communication solution tailored to the unique needs of banks. Whether you want to improve compliance, boost employee engagement, or enhance operational efficiency, QComm is the partner you need.